The long-awaited repayment from Mt. Gox is finally arriving this month, bringing relief to over 20,000 creditors who lost their crypto investments in the 2011 cyber hack that saw the Japanese exchange lose 950,000 BTC.

Historical BTC Chapter

At its peak of success, Mt. Gox was the largest Bitcoin exchange globally, handling 80% of all dollar Bitcoin trades. However, according to the exchange, a critical bug led to the exchange losing 950,000 BTC. By February 2014, Mt. Gox was declared bankrupt.

Only 140,000 BTC, or 14.7% of the total losses, have been recovered so far. Gregory Greene, one of the creditors who lost around $25k in the hack, filed a class-action lawsuit against the exchange and its former CEO.

What’s Next

On June 24, Nobuaki Kobayashi, the court appointed trustee overseeing Mt. Gox’s bankruptcy proceedings, issued an announcement related to replayments. The announcement stated that they have taken extensive measures to ensure safety, technical remedies, and compliance with financial regulations across various countries where creditors reside. After confirming all necessary security measures and discussions about disbursement with crypto exchanges, they are now prepared to initiate repayments.

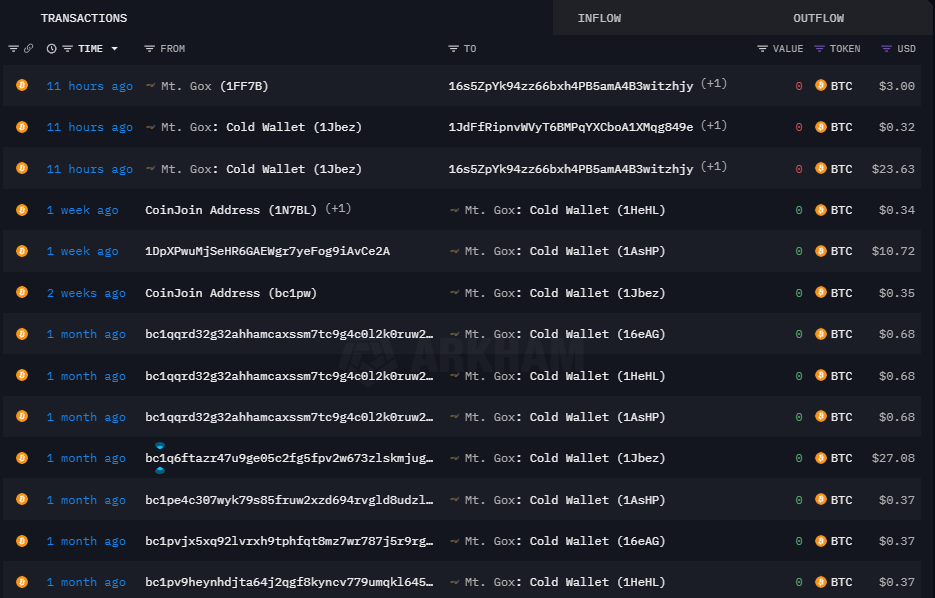

Arkham intelligence data shows that Mt. Gox has performed multiple small amount deposits and withdraws to and from their wallets for the last month.

Following this announcement, a bearish sentiment has swept through the BTC market in anticipation of the $9B repayments. Creditors, who have waited a decade, will gain a remarkable return of 9900% on their initial investments. However, there is a high chance that a major sell-off can be seen. This caused a 20% decline in the BTC market since June 24. It’s a moment of anticipation and sentiment for those awaiting their repayments.