The crypto market is starting the week on a positive note following a calm weekend session, where Bitcoin price oscillated between support at $42,000 and intermediate resistance at $43,000. Trading above this resistance on Monday towards the end of the European session, BTC confirms a stronger bullish theory generally manifesting in select altcoins increases.

The crypto market is showing some varied signals today. While major players like Binance Coin (BNB) and Dogecoin are experiencing modest gains of 1.5%, Chainlink (LINK) is leading the charge with a more impressive 7% jump, reaching $19.43. This suggests investors might be seeking out altcoins with higher potential returns, despite the inherent volatility.

Other altcoins like Toncoin (TON), Polkadot (DOT), and Immutable (IMX) are also showing signs of strength and volatility, indicating a dynamic and uncertain market landscape. Whether these gains are sustainable remains to be seen, but it’s starting to seem like an interesting week for crypto enthusiasts.

Bankrupt Crypto Lender Genesis Seeks To Sell $1.6B In BTC, ETH, ETC Trusts

In a filing made on Friday, Genesis, the bankrupt crypto lender Genesis requested the judge, seeking approval to start offloading more than $1.6 billion held mainly in BTC, ETH, ETC under Grayscale’s trust products.

As Bitcoin steadies following the dip below $39,000 in January, jitters over the potential sale of Genesis’ digital assets holdings are spreading fast.

In January, FTX another bankrupt crypto company offloaded over $1 billion in GBTC holdings believed to have weighed down Bitcoin, contributing to the price sliding below $39,000 from 2024’s peak of $49,000.

Genesis held over $1.4 billion in Grayscale Bitcoin Trust (GBTC). The fund has since been converted to a spot exchange-traded fund (ETF). On top of that, the crypto lender holds $165 million and $38 million respectively in Grayscale Ethereum Trust and Ethereum Classic Trust products.

Genesis filed for bankruptcy in 2022 after its parent firm the Digital Currency Group, a vibrant crypto player failed to navigate a salty crypto landscape due to paralysing losses and irreparable controversies.

Read also: Cryptocurrency Price Prediction For February 5: ETH, ADA, LUNC

Bitcoin Price Prediction: Can Bitcoin Price Navigate The Storm In February

Despite the recovery from below $39,000, a bearish cloud still hovers above BTC price. The situation could worsen if Genesis receives approval to sell its shares of the GBTC ETF. Over $1.4 billion leaving the market could slow down the climb to $50,000 or trigger another sell-off under $40,000.

Bitcoin is valued at $43,127 but oscillates in a narrow range between $39,000 and $44,000. If investors take advantage of the consolidation and keep accumulating BTC, a strong tailwind could blast the coin upwards closing the distance to $50,000.

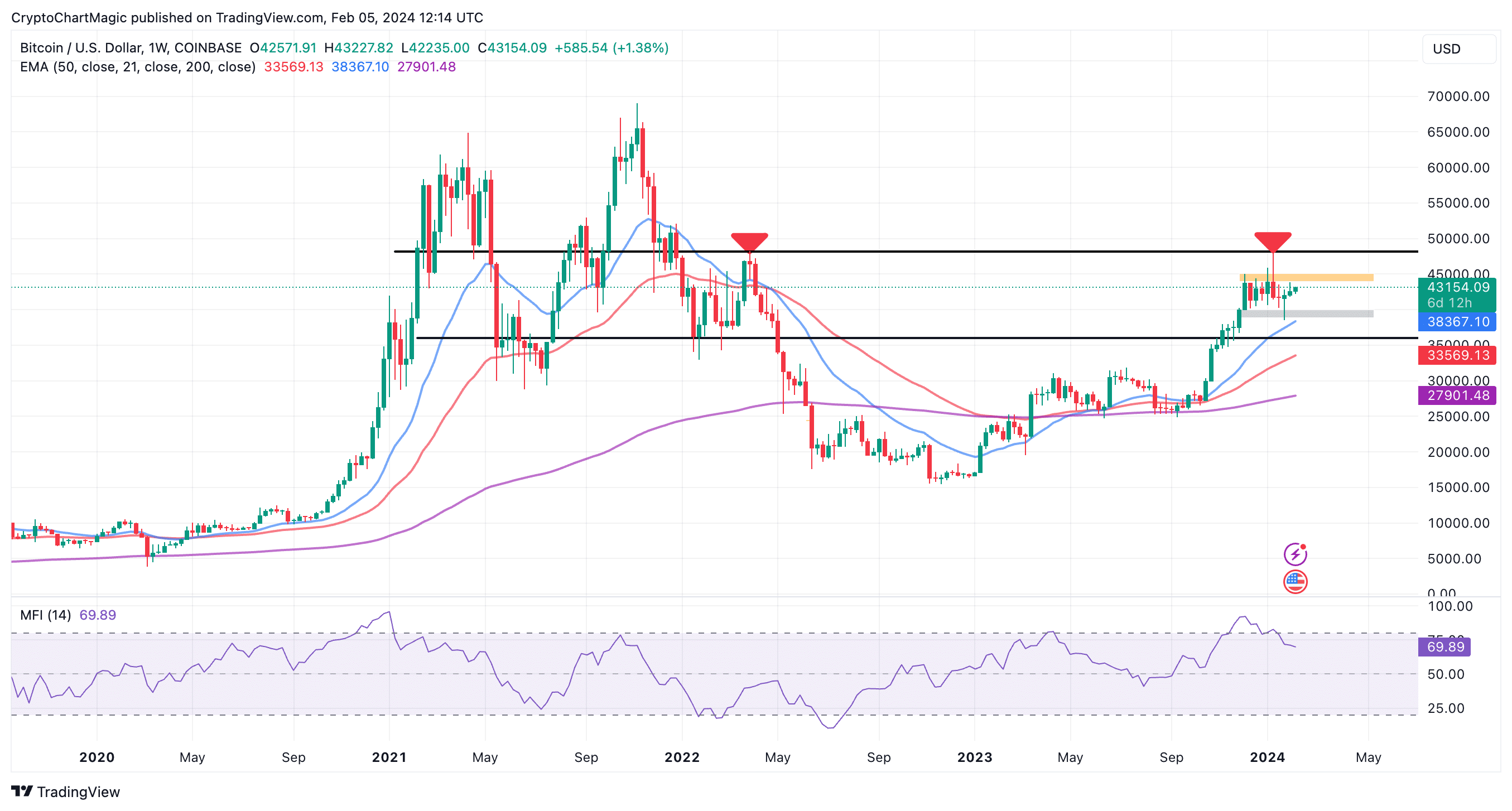

Bitcoin price chart | Tradingview

However, with the Money Flow Index (MFI) neutral and falling, the path of least resistance could gradually shift downward. This indicator monitors the money flowing in and out of the market, with persistent high outflows suggesting sellers are getting stronger.

On the other side of the fence, Bitcoin sits on top of key bull market indicators, including the 20-week Exponential Moving Average (EMA), the 50 EMA, and the 200 EMA all of which are catching up to the price.

If Bitcoin price slides below $40,000, the 20-week EMA (the blue line on the chart) will provide additional support at $38,367. The wider range low at $36,000 remains a price level to watch as it is likely to boost liquidity and a larger breakout.

A successful retest of resistance at $44,000 could mean that buyers have the reins and Bitcoin has a higher chance of closing the gap to $50,000 in February.

Related Articles

- Jupiter Price Prediction With JUP Pumping To $0.62 While Bitcoin Price Tops $43,000

- XRP Price Prediction As Emerging Pattern Hints $0.5 Support Could Crumble

- Celestia Price Climbs 8%, Who’s Leading TIA’s Profit Parade?