TRON’s (TRX) price dynamics indicate a move towards potentially lower volatility, highlighted by reduced trader activity in the past week.

The Relative Strength Index (RSI) has adjusted to a neutral level at 60, suggesting that TRX is entering a phase of consolidation.

TRON Eyes a Consolidation Phase

The 7-day RSI for TRX has decreased from highs of 84.6 to 60.8. This is a pivotal metric for gauging whether TRON is overbought or oversold. It currently indicates a balanced market sentiment and equilibrium between buyers and sellers, pointing to potential consolidation ahead.

This period of consolidation, marked by stable prices within a narrow range, implies a balanced market sentiment that is likely to dominate in the upcoming days.

TRX Relative Strength Index. Source: Santiment.

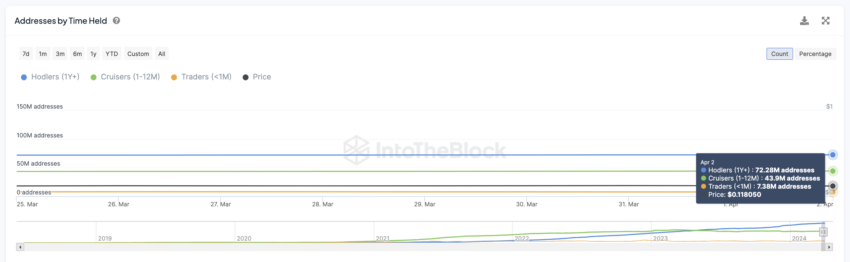

After months of increased activity, TRX has also seen a decrease in the number of traders holding the cryptocurrency, with a decline from 7.52 million addresses on March 25 to 7.38 million by April 2. This change suggests a move towards lesser price volatility, potentially leading to a more consolidated market phase.

TRX Addresses by Time Held. Source: Santiment.

TRX Price Prediction: Enough Support?

TRX recently experienced a technical pattern known as a death cross on April 2, where a short-term Exponential Moving Average (EMA) falls below a long-term EMA, often seen as a bearish signal. This event followed a 22.34% price correction after the previous death cross on March 5.

Given this scenario, TRX might enter a phase of consolidation, particularly with its RSI positioned at 60. Should the $0.1145 support level falter, TRX could decline towards $0.097, marking a low since December 2023.

TRX Price Chart. Source: TradingView.

Conversely, bullish market sentiment could propel TRX towards testing the $0.14 resistance level, potentially initiating an uptrend.