Blockchain technology has evolved rapidly, with Layer 1 and Layer 2 chains offering distinct benefits. Layer 1 chains like Bitcoin and Ethereum are foundational, providing strong security and decentralisation. On the other hand, Layer 2 chains like Polygon focus on scalability, enabling faster and cheaper transactions. This article explores the top five Layer 1 chains and the top five Layer 2 chains, comparing their features.

1. Difference B/W Layer 1 & Layer 2 Chains

Layer 1 refers to the base layer or foundational blockchain protocol. It is the primary blockchain structure where transactions are validated and recorded on the ledger. Layer 2 refers to protocols or solutions built on top of Layer 1 blockchains to enhance their scalability and throughput. L2 chains rely on the underlying security of Layer 1 but provide additional features for more efficient transaction processing.

2. Layer 1 Vs. Layer 2 Blockchains: A General Comparison

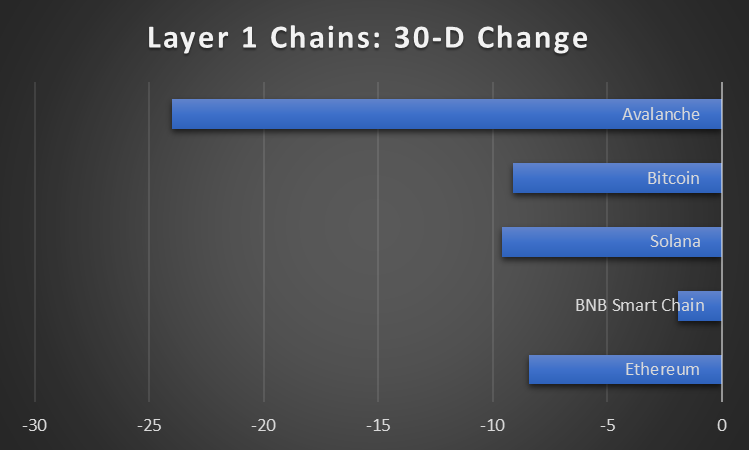

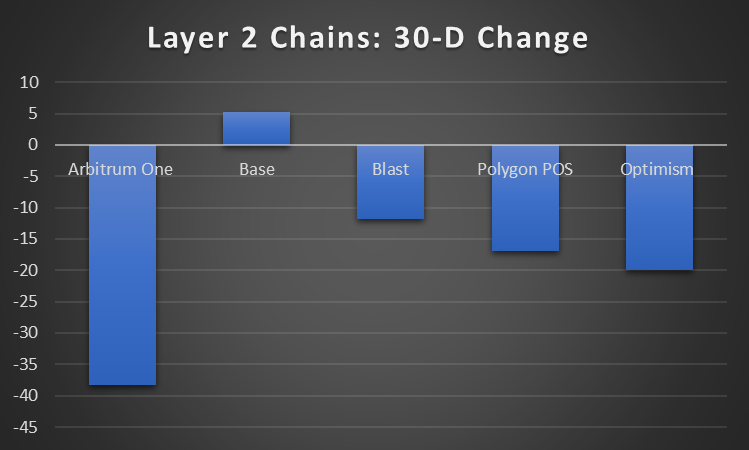

Ethereum, BNB Smart Chain, Solana, Bitcoin and Avalanche are the top five Layer 1 chains, and the top five Layer 2 Chains are Arbitrum One, Base, Blast, Polygon POS, and Optimism.

| Layer 1 Chains | 30d Change | Dominance | TVL | 24H Volume |

| Ethereum | -8.4% | 77.81% | $53,358,721,527 | $1,111,683,396 |

| BNB Smart Chain | -1.9% | 9.04% | $6,197,242,582 | $484,704,850 |

| Solana | -9.6% | 6.03% | $4,134,122,151 | $1,127,276,517 |

| Bitcoin | -9.1% | 1.74% | $1,196,334,760 | N/A |

| Avalanche | -24.0% | 1.35% | $927,792,677 | $41,441,536 |

Ethereum dominates the Layer 1 chain sector, with 77.81% dominance. BNB Smart Chain and Solana follow with 9.04% and 6.03%.

Among the top five layer 1 chains by dominance and TVL, none show positive change. Avalanche records a negative 30-day change of -24.0%. Solana follows with -9.6%. Bitcoin registers a change of -9.1% and Ethereum -8.4%.

| Layer 2 Chains | 30d Change | Dominance | TVL | 24H Volume |

| Arbitrum One | -38.3 | 29.32% | $2,617,062,331 | $366,336,889 |

| Base | +5.2 | 17.48% | $1,560,487,781 | $325,216,985 |

| Blast | -11.9 | 16.84% | $1,503,375,743 | $74,657,158 |

| Polygon POS | -17.0 | 10.13% | $903,953,944 | $105,306,416 |

| Optimism | -19.9 | 9.52% | $850,101,770 | $71,342,906 |

In the Layer 2 sector, Arbitrum One dominates with 29.32% dominance. Base and Blast closely follow with 17.48% and 16.48%, respectively.

Among the top five Layer 2 chains by dominance and TVL, only Base shows positive change; it records a change of +5.2%. Arbitrum One display the worst change of -38.3%. Optimism, Polygon POS, and Blast follow with -19.9%, -17.0%, and -11.9%, respectively.

3. Layer 1 Vs. Layer 2 Blockchains: Comparing Features

3.1. Blockchain Scalability Analysis

To analyse scalability, we can use Real-Time TPS, Max Recorded TPS and Max Theoretical TPS.

Real-Time TPS shows how many transactions per second a blockchain is processing. This metric is calculated by taking different time intervals. Here, we consider the one-month timeframe.

Max Recorded TPS records the highest number of transactions per second achieved by a blockchain in its history.

Max Theoretical TPS represents how many transactions per second the blockchain is theoretically capable of handling.

| Layer 1 Chains | Real-Time TPS | Max Recorded TPS | Max Theoretical TPS |

| Ethereum | 13.75 tx/s | 62.34 tx/s | 119 tx/s |

| BNB Smart Chain | 44.02 tx/s | 1,731 tx/s | 2,222 tx/s |

| Solana | 860 tx/s | 1,624 tx/s | 65,000 tx/s |

| Bitcoin | 5.98 tx/s | 12.36 tx/s | 7 tx/s |

| Avalanche | 2.79 tx/s | 92.74 tx/s | 357 tx/s |

| Layer 2 Chains | Real-Time TPS | Max Recorded TPS | Max Theoretical TPS |

| Arbitrum One | 19.2 tx/s | 532 tx/s | 40,000 tx/s |

| Base | 30.05 tx/s | 293 tx/s | 1,429 tx/s |

| Blast | N/A | N/A | N/A |

| Polygon POS | 47.53 tx/s | 282 tx/s | 649 tx/s |

| Optimism | 7.86 tx/s | 32.87 tx/s | 714 tx/s |

Among the top five Layer 1 and Layer 2 chains, Solana, a Layer 1 blockchain, records the highest Max Theoretical TPS of 65,000 transactions per second. Arbitrum One, a Layer 2 chain, follows closely with 40,000 transactions per second. BNB Smart Chain, a Layer 1 chain, registers the highest Max Recorded TPS of 1,731 transactions per second. Solana and Arbitrum One follow with 1,624 tx/s and 532 tx/s, respectively.

3.2. Blockchain Latency Analysis

To analyse latency, we use two indices: TTF and Block Time.

TTF, or Time To Finality, is the duration of time it takes for a transaction to be considered completed in a blockchain network.

Block Time is the average amount of time it takes for a new block to be added to a blockchain.

| Layer 1 Chains | TTF | Block Time |

| Ethereum | 16 minutes | 12.09 seconds |

| BNB Smart Chain | 7.5s | 3.01s |

| Solana | 12.8s | 0.47s |

| Bitcoin | 1h | 10m 9s |

| Avalanche | 0s | 2.09s |

| Layer 2 Chains | TTF | Block Time |

| Arbitrum One | 16 minutes | 0.25 seconds |

| Base | 16m | 2s |

| Blast | N/A | N/A |

| Polygon POS | 4m 16s | 2.28s |

| Optimism | 16m | 2s |

Among the top five Layer 1 and Layer 2 chains, Avalanche, a Layer 1 chain, is the one which takes the lowest duration to complete a transaction. BNB Smart Chain and Solana, both Layer 1 chains, follow with 7.5 seconds and 12.8 seconds. Bitcoin, a Layer 1 chain, is also the one which takes the highest time to process a transaction. It takes at least one hour. Among the top five Layer 2 chains, Polygon POS is the best, as it only requires four minutes and sixteen seconds.

In terms of Block Time, Layer 2 chains are far better than Layer 1 chains. None of the top five Layer 2 chains need more than two seconds to add a new block to the chain. Arbitrum One only requires 0.25 seconds. Among the Layer 1 chains, Solana is the best, as its block time is as low as 0.47 seconds. Avalanche follows with 2.09 seconds. The blockchain with the highest block time is Bitcoin, which requires over ten minutes to add a new block to its chain.

3.3. Blockchain Cost Analysis

To analyse cost, we can use the Gas Fee index. Gas price is the amount of money that users are willing to pay per unit of “gas.” Gas is a measure of computational effort required to perform a task or transaction on the blockchain.

| Layer 1 Chains | Gas Fees |

| Ethereum | $0.38 |

| BNB Smart Chain | $0.014 |

| Solana | N/A |

| Bitcoin | N/A |

| Avalanche | $0.021 |

| Layer 2 Chains | Gas fees |

| Arbitrum One | $0.00076 |

| Base | $0.011 |

| Blast | $0.00071 |

| Polygon POS | $0.00047 |

| Optimism | $0.0039 |

Analysing the top five Layer 1 chains and Layer 2 chains, it becomes evident that Layer 2 chains are far cheaper than Layer 1 chains. Polygon POS, a Layer 2 Chain, is the chain with the lowest Gas Fee. It has a Gas Fee of $0.00047. Blast and Arbitrum One follow with $0.00071 and $0.00076, respectively. Among the Layer 1 chains, BNB Smart Chain is the cheapest with a Gas Fee of just $0.014. Avalanche follows with $0.021.

3.4. Blockchain Governance Analysis

Blockchains rely on various governance mechanisms for decision-making. On-Chain, Off-Chain, Council and Multisig are the prominent methods of governance. On-Chain is a method that allows decentralised communities to update a blockchain through direct on-chain voting. Off-Chain is a method where decisions are informally made off-chain. Council is a method that involves a selected group of individuals responsible for determining the blockchain’s decision-making. Multisig is a method that involves a single entity empowered to independently adjust the core parameters of the blockchain.

| Layer 1 Chains | Governance |

| Ethereum | Off-Chain |

| BNB Smart Chain | On-Chain |

| Solana | Off-Chain |

| Bitcoin | Off-Chain |

| Avalanche | On-Chain |

| Layer 2 Chains | Governance |

| Arbitrum One | On-Chain |

| Base | Off-Chain |

| Blast | N/A |

| Polygon POS | Off-Chain |

| Optimism | On-Chain |

Among the top five Layer 1 Chains by dominance, BNB Smart Chain and Avalanche are the ones which use the On-Chain governance method. Others utilise the Off-Chain method.

Among the top five Layer 2 Chains by dominance, Arbitrum One and Optimism follow the On-Chain governance method. Base and Polygon POS are governed using the Off-Chain method.

Endnote

Layer 1 and Layer 2 chains offer unique advantages in the blockchain ecosystem. Layer 1 chains focus on security and decentralisation, while Layer 2 chains emphasise scalability and speed. This comparative analysis has highlighted almost all the key points, helping you understand the strengths and weaknesses of each chain to make informed decisions in the blockchain space.