Changpeng Zhao, known widely as “CZ,” is a pivotal figure in the digital finance realm whose career trajectory exemplifies both meteoric rise and significant setbacks within the cryptocurrency industry. As the founder of Binance, the largest global cryptocurrency exchange by trading volume, Zhao’s influence has been substantial. However, his journey has been fraught with regulatory challenges that culminated in his dramatic resignation.

Launched in 2017, Binance quickly became a dominant force in the cryptocurrency market under Zhao’s leadership. Originating from a modest background in China, Zhao leveraged his experience in software development to build an exchange that facilitated billions in crypto transactions. Due to its user-friendly interface and a wide array of supported currencies, Binance appealed to users worldwide. Binance’s success skyrocketed, with Zhao’s wealth peaking at an astonishing $96.6 billion in January 2022, according to Bloomberg.

Regulatory Hurdles and Legal Scrutiny

Despite its success, Binance soon encountered significant regulatory resistance. The platform was scrutinized for its operational practices, with allegations of facilitating unregistered trading and inadequate anti-money laundering protocols. Regulatory bodies in key markets such as the U.S. and the U.K. expressed concerns, with the U.K.’s Financial Conduct Authority blocking Binance’s local operations over compliance issues.

The crescendo of legal challenges reached a pivotal moment when the U.S. Securities and Exchange Commission (SEC) and other regulators intensified their oversight. Zhao was personally implicated in a series of legal accusations, including mismanagement of client funds and operating an illegal securities exchange. These accusations led to a lawsuit from the SEC, which accused Binance of commingling customer and company funds and engaging in deceptive practices.

In a landmark development, Zhao pled guilty to charges related to violating anti-money laundering regulations and stepped down as CEO as part of a broader settlement that included a $4.3 billion fine paid by Binance to resolve the investigations by the Department of Justice and the Commodity Futures Trading Commission. This settlement also stipulated that Binance enhance its compliance measures to align with U.S. regulations, fundamentally shifting the company’s operational framework.

Financial Aftermath and Wealth Fluctuations

Despite these challenges, Zhao’s financial status remains robust but fluctuating. By the end of 2023, his estimated wealth had rebounded to $37.2 billion amid a recovery in the cryptocurrency market. This figure represents a significant drop from his peak wealth but underscores his continued financial influence in the industry. Zhao’s holdings include a substantial 90% stake in Binance and an 86% ownership of Binance.US, reflecting his deep financial ties to the exchange’s ongoing operations.

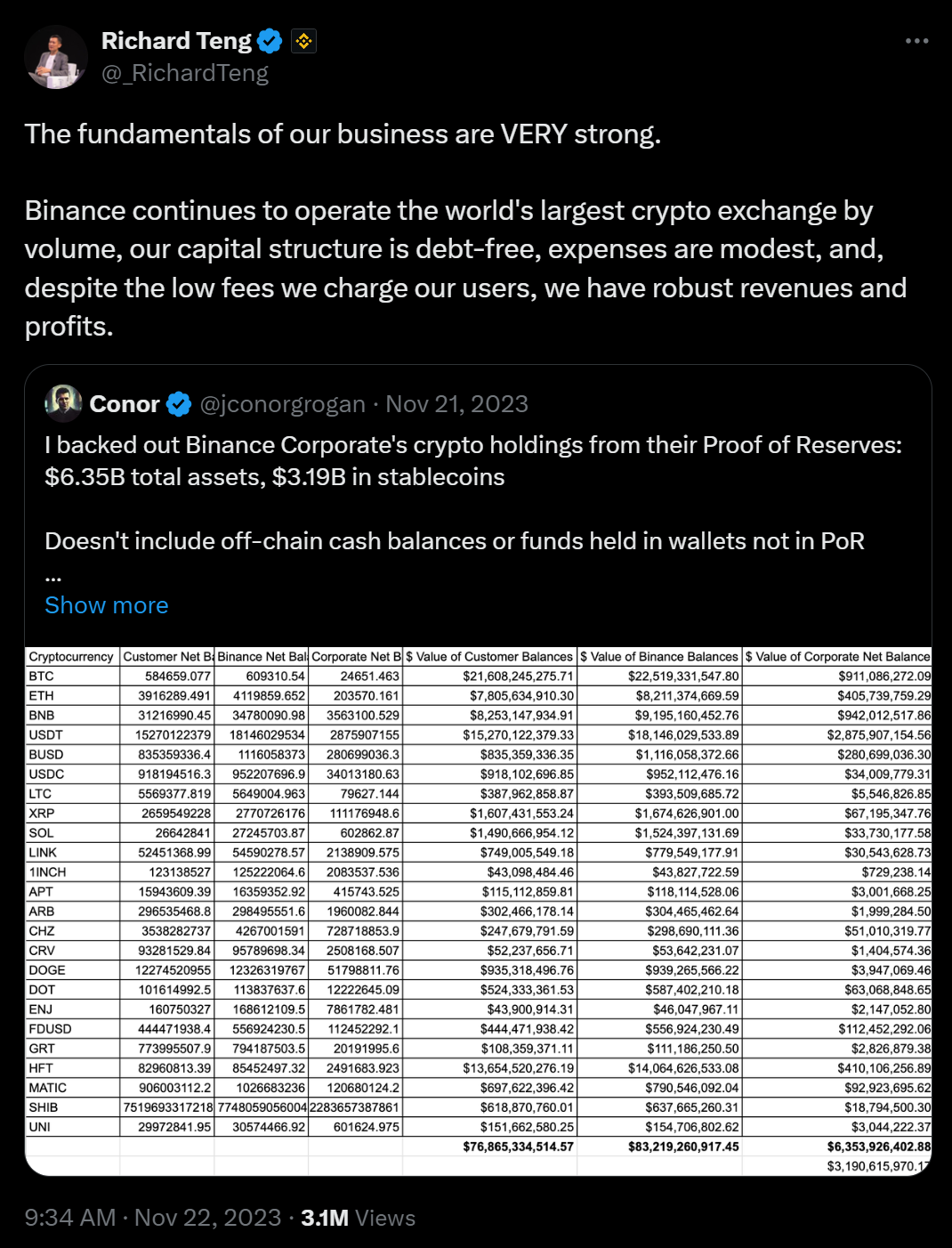

Following Zhao’s resignation, Richard Teng, previously the head of Binance’s regional markets and a seasoned financial regulator, took over as CEO. Teng’s appointment marks a strategic pivot towards strengthening regulatory compliance and restoring stakeholder trust. His leadership is expected to focus on navigating Binance through the evolving regulatory landscape and reinforcing its commitment to legal and ethical business practices.

Changpeng Zhao’s narrative is emblematic of the volatile interplay between innovation and regulation in the cryptocurrency sector. His rise and fall echo the broader challenges facing digital finance, where rapid growth often meets stringent regulatory checks. As Binance transitions under new leadership, the industry watches keenly to see how it adapts to the demands of global financial governance, setting a precedent for other entities in the crypto space. Zhao’s legacy, marked by both visionary entrepreneurship and cautionary tales of regulatory oversight, continues to influence the trajectory of cryptocurrency regulations and market dynamics.