Welcome to the On the Margin Newsletter, brought to you by Ben Stack, Casey Wagner and Fexlix Jauvin. Here’s what we unpack in our inaugural edition:

- The European Central Bank has led the rate-cutting charge, even as the inflation rate across the pond remains high. Will the Fed take a page from its book tomorrow?

- Find out why more companies are buying bitcoin for their treasuries (hint: everyone wants an inflation-proof asset).

- Wednesday is a huge day with CPI figures dropping in the morning and the FOMC wrapping in the afternoon. Keep reading to know what analysts are saying and what you should be watching for.

Global rate-cutting season

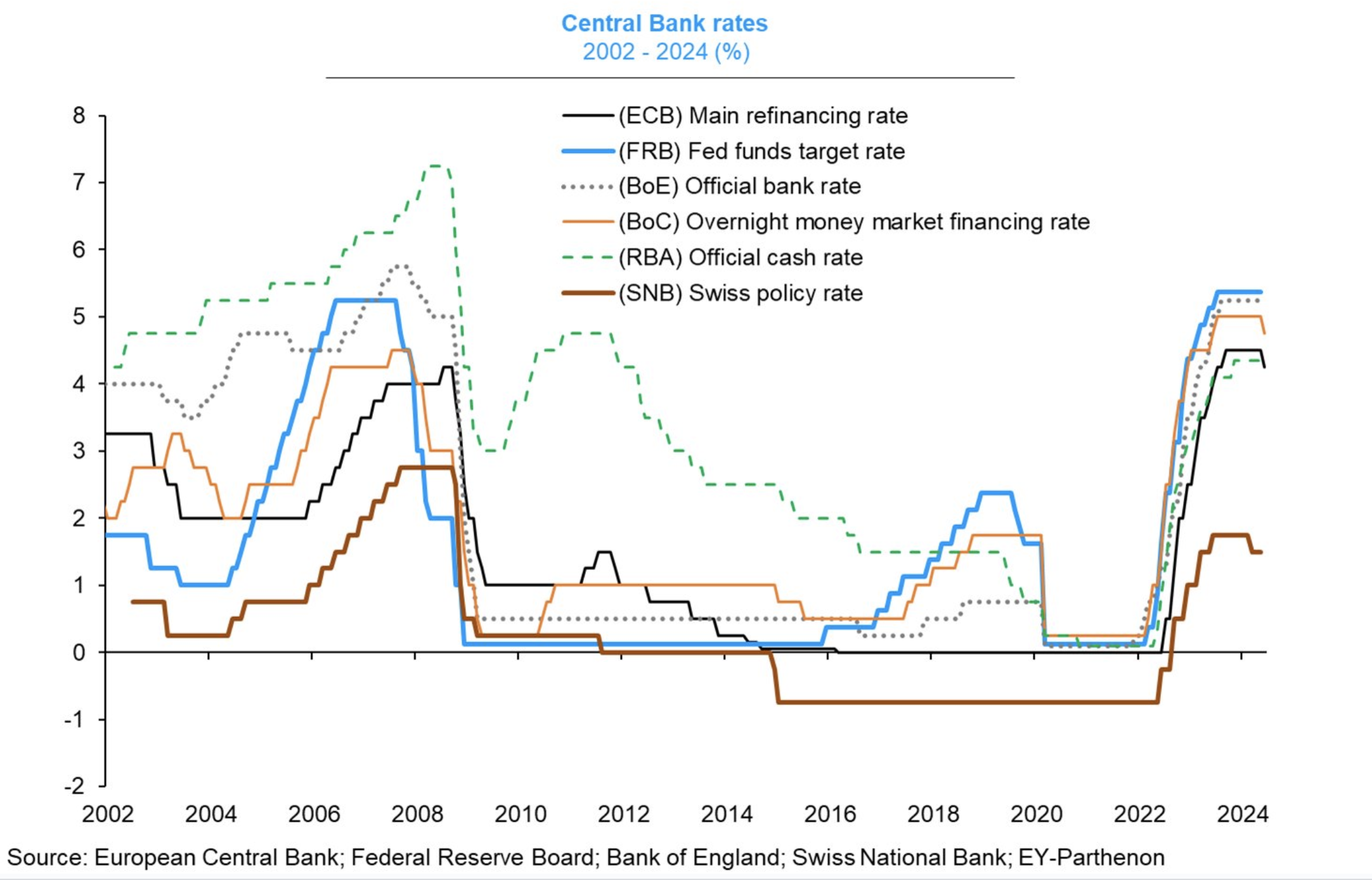

This week marked the start of the global rate-cutting cycle, with the Bank of Canada and the European Central Bank leading the charge.

The Bank of Canada kicked things off last Wednesday, slashing the overnight rate by 25 basis points and suggesting that as long as inflation continues to fall, more cuts could follow. The very next day, the ECB followed suit, also cutting rates by 25 bps.

However, the ECB took a more hawkish stance on future cuts, citing persistent high inflation and ruling out additional cuts in the near-term. Simultaneously, the ECB raised its inflation forecast by 0.2% for 2024 and 2025.

The timing is particularly intriguing. Typically, higher inflation forecasts would lead to more hawkish policies. Some argue that the ECB, having painted itself into a corner, felt compelled to cut rates to stay true to its forward guidance despite rising inflation. This move, they argue, reveals the ECB’s true concerns.

On the other hand, there’s a compelling argument that the ECB has openly acknowledged a significant issue. In a world burdened with high debt-to-GDP ratios, high interest rates increase financial system fragility by channeling a larger portion of incomes toward debt servicing. This complicates monetary policy, as letting rates rise naturally could inflict severe economic pain.

One way to address this is by keeping interest rates low and allowing inflation to exceed targets for an extended period — a strategy known as financial repression. This approach reduces debt-to-GDP ratios and allows the economy to deleverage without the harsh effects of austerity. The downside is currency devaluation and diminished purchasing power, particularly for savers holding sovereign debt with returns below inflation rates.

Financial repression works until inflation spirals out of control, forcing central banks to adopt aggressive tightening measures (as seen in 2021 when the Fed shifted from downplaying inflation to rapid rate hikes), or until public discontent with inflation leads to societal pushback against the policy.

Occam’s razor suggests the ECB’s rate cut might simply be a one-off move, driven by its previous guidance. However, the theory of financial repression shouldn’t be dismissed as history provides numerous examples, such as post-World War II economic policies.

As we head into this week’s FOMC meeting and CPI release — both scheduled for the same day — it’s worth thinking about.

— Felix Jauvin

19

The number of trading days in a row US spot bitcoin ETFs collectively notched net inflows — before that record streak for the segment ended Monday.

These products have now been live for five months, to the day. The category saw net money go in on 72 of those 104 days (a nearly 70% clip).

The largest bitcoin ETF, BlackRock’s iShares Bitcoin Trust (IBIT), has tallied net inflows on 91 days — making it flow-positive 88% of the time. IBIT was managing $21.2 billion in assets as of Monday.

Total net inflows for the 10 spot BTC funds tracked by Farside Investors stand at $15.6 billion. That comes even with the Grayscale Bitcoin Trust ETF (GBTC) seeing $18 billion worth of investor capital exit the fund.

BTC on more balance sheets

More companies are hoarding bitcoin for their treasuries — a tactic made famous by Michael Saylor-led MicroStrategy.

Whether these firms look to emulate MSTR, use a gimmick to boost their share price or genuinely believe in BTC, the macro landscape makes the decision less taboo than perhaps it once was.

Saylor’s business intelligence-slash-software company started stashing bitcoin in 2020. Its pile grew to 214,400 BTC as of April 26 — worth $14.3 billion on Tuesday morning.

Tesla in 2021 bought $1.5 billion of bitcoin “to further diversify and maximize returns on our cash,” it said in an SEC filing. The company held $184 million of digital assets on its balance sheet as of March 31.

MicroStrategy stock is up 118% year to date. This “wildly successful” proof of concept has shown others it can be a prudent way to return value to shareholders, noted Swan Bitcoin research analyst Sam Callahan.

Then there’s the new FASB accounting rules, which make it easier for corporations to hold bitcoin on their balance sheets.

And so we saw Japanese investment firm Metaplanet look to become Asia’s MicroStrategy in April. Medical tech company Semler Scientific bought $40 million of BTC last month and DeFi Technologies just this week revealed its purchase of 110 BTC.

“I expect this strategy to become popular as inflation continues to erode the purchasing power of cash and cash-like equivalents, leading corporations to seek alternatives,” Callahan said.

ProChain Capital President David Tawil said he doesn’t think firms like Semler or DeFi Technologies are necessarily looking to be a “MicroStrategy junior” — noting there likely isn’t room in the market for that. Rather, they’re using BTC for value appreciation, particularly in this macro environment.

Sure, the earlier adopters of this maneuver may be firms with less to lose. But bigger, more “serious” players are likely to ultimately jump aboard, Tawil told Blockworks.

He added: “And then we’re off to the races.”

— Ben Strack

Happy CPI Report AND Fed Day Eve!

Tomorrow is a big day. We get May’s CPI report in the morning before the market opens; then the Fed will release its interest rate decision and projections prior to its close.

First, let’s take a look at the historical impact on equity prices during an FOMC week. As DataTrek Research founder Nicholas Colas pointed out, there has been a shift in recent years.

From 1994 to 2011, the S&P 500’s total yearly return came in the three days surrounding FOMC meetings. That trend is, of course, long dead. In the past 18 months (during which there were 12 FOMC meetings), the S&P 500 has only gone up around half of the time between Monday and Thursday of Fed weeks.

But starting a Fed day with a CPI print adds a fun twist.

Analysts from JPMorgan are calling for May’s month-over-month figure to show a roughly 0.3% increase in prices, which should have minimal impact on markets. UBS analysts are similarly expecting the yearly inflation figure to come in close to the last read of 3.4% recorded in April, which should be enough to convince investors that prices are in fact trending lower.

Either way, the impact of the CPI report will be short-lived. Whatever Jerome Powell says in the afternoon — and what the projections show — will answer the main question a CPI report always raises: what does this mean for interest rates?

— Casey Wagner

Bulletin Board

- All’s well after Wells notice? Despite months of regulatory headwinds, crypto companies are remaining resilient, Consensys legal chief Bill Hughes said.

- Fidelity International joined JPMorgan’s Tokenized Collateral Network (TCN), the firms announced Monday. Fidelity International tokenized shares of its money market fund through TCN, which is built on Onyx, JPMorgan’s private blockchain network.

- Just in time for Roaring Kitty’s latest market-moving comments, a new book on the WallStreetBets subreddit is here. Read the Blockworks review from opinion editor Molly Jane Zuckerman here.