Widely followed crypto analyst Benjamin Cowen is offering his outlook on when Bitcoin (BTC) could potentially bottom out as the flagship digital asset hovers around $63,000.

In a new video update, Cowen tells the 801,000 subscribers of his YouTube channel that the current Bitcoin price action resembles that which followed the crypto king’s second halving event eight years ago more so than the halving in 2020.

“It looks to me like it’s mimicking 2016 a lot more than the other two cycles, which kind of makes sense. I mean a lot of people who’ve been following Bitcoin for a while have been comparing this cycle more so to the 2016 cycle than the one in 2020.”

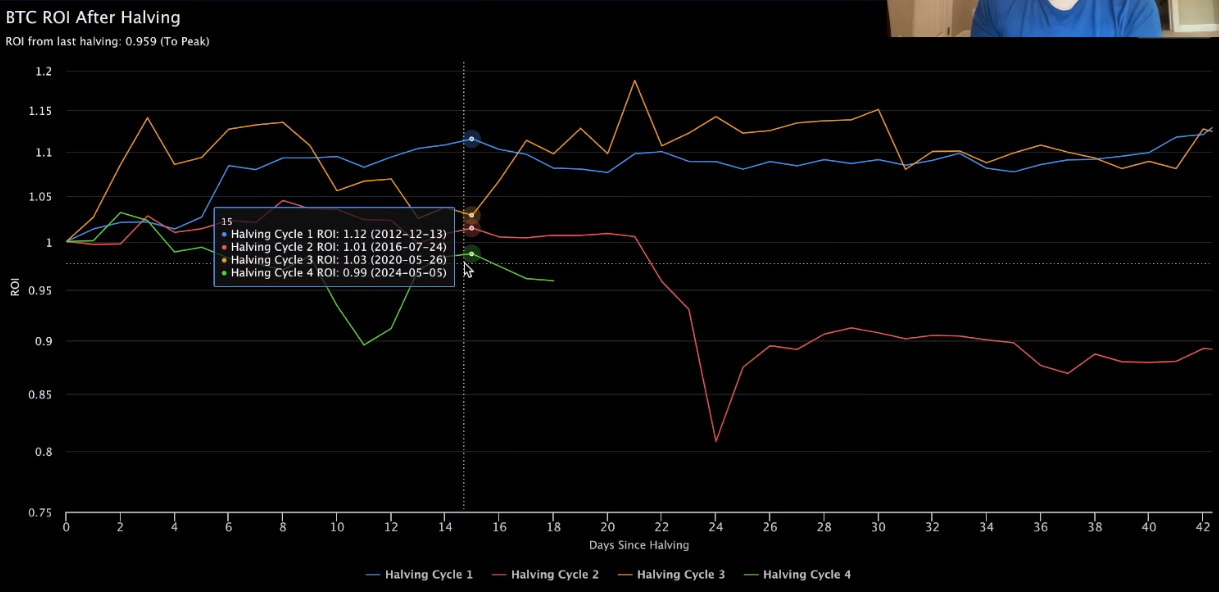

Source: Benjamin Cowen/X

According to Cowen, the flagship crypto asset could potentially hit the cycle bottom over the coming weeks based on the Bitcoin Return on Investment (ROI) After Halving metric. The Bitcoin ROI After Halving metric is the ratio of the current price relative to the price of BTC at the time of halving. The latest halving, which cuts miners’ rewards in half every four years, occurred on April 19th.

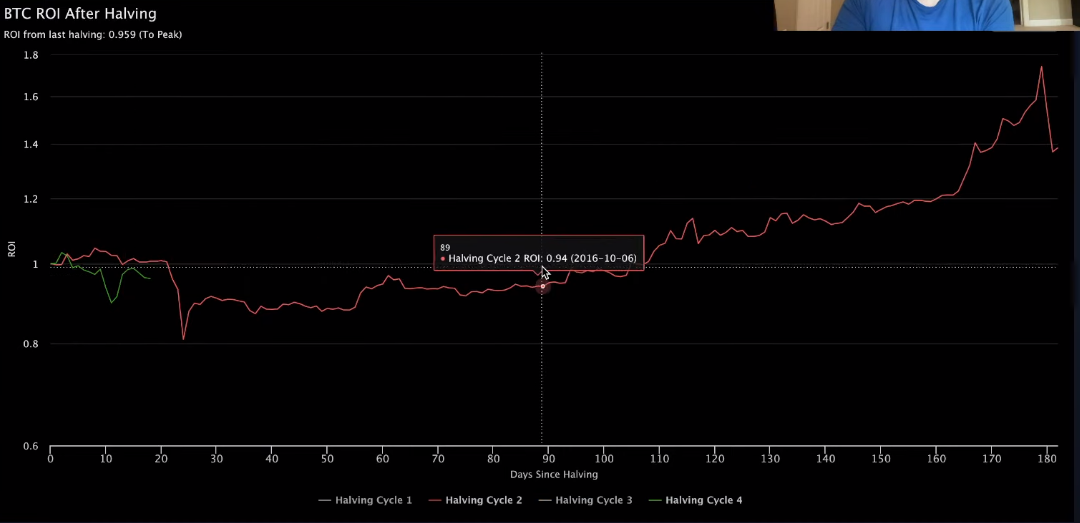

“If you look at 2016, which might be relevant to compare to, you can see that Bitcoin didn’t durably get back above an ROI of one until about three and a half months after the halving.

And I don’t know if it’s going to play out like that or not, but you can see that that would be more evidence of a summer low. That could potentially be more evidence for a summer low if you look at Bitcoin’s ROI as a measure from the halving and compare it to the 2016 cycle.”

Source: Benjamin Cowen/X

Bitcoin is trading for $62,798 at time of writing, a fractional increase during the last 24 hours.

Generated Image: DALLE3