Ethereum’s price has failed to climb back above the $4,000 level and is currently dropping lower. While the market is correcting at the moment, a bullish rebound is still possible in the near future.

Technical Analysis

By TradingRage

The Daily Chart

On the daily timeframe, the price was rejected from the $4,000 level back in March and is yet to recover. The market has also failed to claim back the $3,500 level and has been rejected lower from this zone.

Currently, the $3,000 support level seems like a probable target, as the Relative Strength Index has also broken below 50%. Yet, the bullish trend might not be over yet, as the price is still trading above the 200-day moving average.

The 4-Hour Chart

Looking at the 4-hour chart, the recent market consolidation seems clearer. The price created a rising wedge and broke it to the downside, which is a classical bearish continuation pattern.

While ETH is approaching the $3,000 support level, the RSI is dropping below the 30% mark, which indicates ETH is oversold in this timeframe. Therefore, it might only be a matter of time before the price rebounds higher, probably from the $3,000 support zone.

On-Chain Analysis

By TradingRage

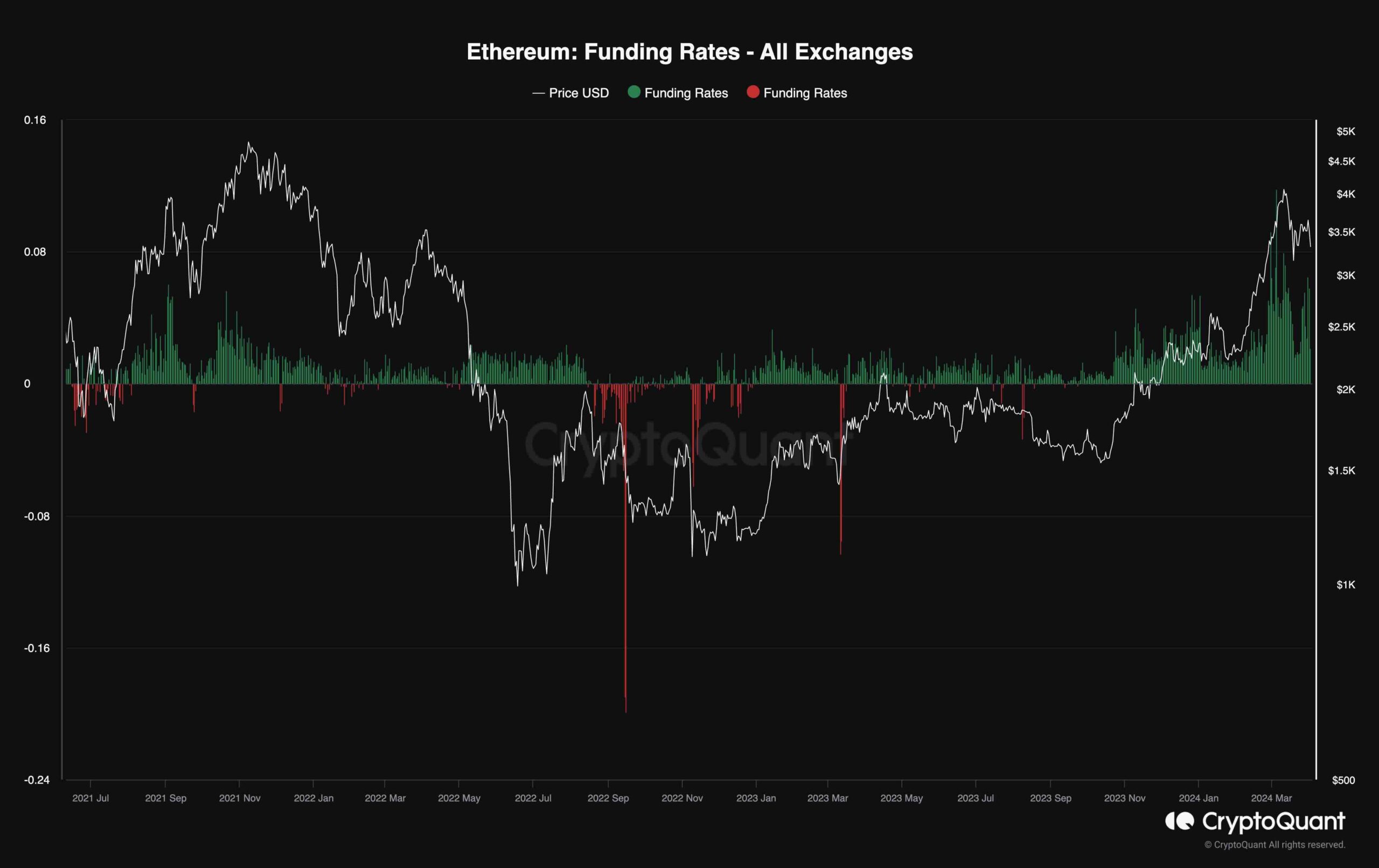

Ethereum Funding Rates

Ethereum’s price has been dropping below $4,000 recently, failing to continue its upward momentum. A potential reason for the recent decline might be the extreme optimism of investors.

This chart demonstrates the funding rates metric. They indicate whether the buyers or sellers are executing their orders more aggressively on aggregate. Positive values support bullish sentiment, while negative values show bearish sentiment, which usually shows a state of fear in the market.

As the chart depicts, the funding rates have been extremely high recently. This could have led to a long liquidation cascade, which in turn has resulted in a drop below the $4,000 level. So long as the funding rates remain high and, therefore, the futures market is overheated, a sustainable rally is unlikely.