Bloomberg’s commodity market expert Mike McGlone warns of a potential downturn for bitcoin, highlighting its disappointing performance against gold since its peak in 2021. On Sunday, McGlone pointed out that the bitcoin/gold ratio had plummeted by about 40% from its 2021 zenith of 37 times.

McGlone Highlights Bitcoin-to-Gold Ratio, Warns of Potential Downturn vs Gold

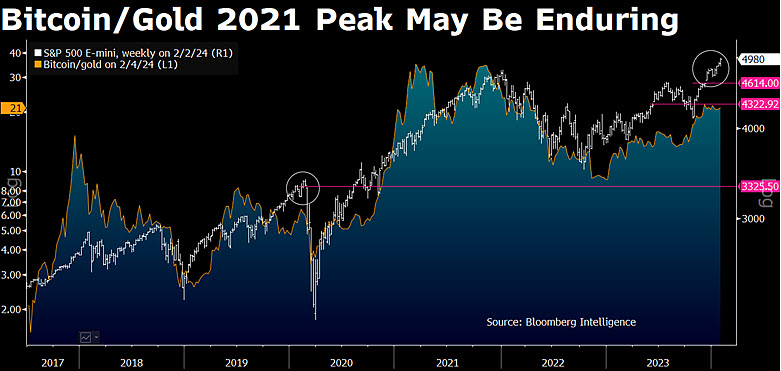

Mike McGlone, a Bloomberg commodity analyst, remarks that bitcoin (BTC) has fallen short of gold’s performance since reaching its peak in 2021. On Sunday, McGlone offered his most recent evaluation of certain commodities, incorporating BTC into his analysis. “Pattern Recognition, Gaps and Gold vs. Bitcoin — Since they began trading in 1997, S&P 500 E-mini futures never left a gap on the weekly charts until December — from 4,614 to 4,652 — with back-and-fill implications for risk assets,” the analyst wrote.

McGlone added:

My graphic shows two previous chart holes since 2017 that were subsequently filled. What’s notable is the bitcoin-to-gold ratio, which has a tendency to lead beta, has been trailing since the biggest money pump in history to the 2021 high. The 24-7 traded highly speculative digital asset might be a top leading indicator and equivalent to about 21 ounces of gold on Jan. 2. The ratio is about 40% below the 37x 2021 apex.

Chart McGlone shared on Feb. 4, 2024.

McGlone’s insights on this topic aren’t new; he previously discussed the bitcoin-to-gold ratio on Jan. 23, 2024. McGlone suggested that bitcoin’s underperformance compared to gold, despite a high-performing U.S. stock market since 2021, could signal either an opportunity for bitcoin to catch up or indicate a recession. He leans towards the possibility of a recession, highlighting concerns if the Bitcoin/gold ratio continues to decline.

This shift is attributed to the end of zero-interest-rate policies (ZIRP) and the 2021 liquidity surge. With current Federal Reserve’s federal fund rate at 5.58, the scenario has changed, impacting assets like gold and bitcoin that don’t generate earnings or interest, making them less attractive in portfolios. “The crypto exchange-traded fund frenzy might be looked back upon as a bell ringing at the top,” McGlone said at the time.

What do you think about McGlone’s analysis concerning the bitcoin-to-gold ratio? Let us know what you think about this subject in the comments section below.