Observing the movements of ‘whales’—investors who hold large amounts of cryptocurrency—can offer crucial insights for both traders and investors as they navigate the complex dynamics of the cryptocurrency market. These whales are characterized by their significant capitalization and a proven track record of profitable trading, often influencing market trends and liquidity.

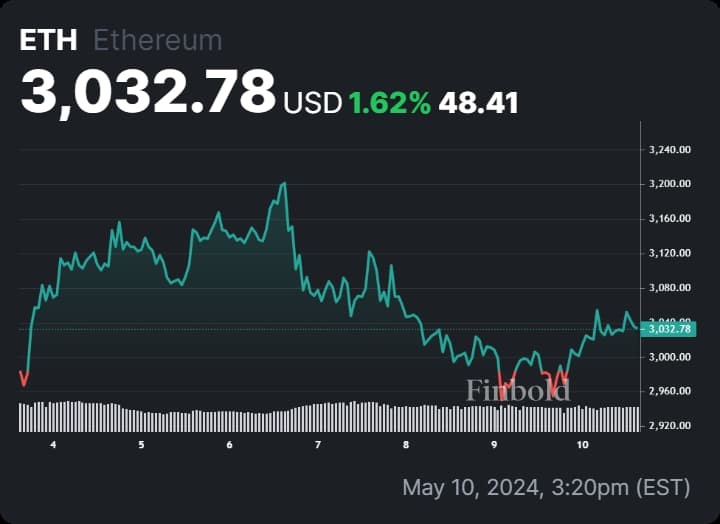

A significant Ethereum (ETH) whale has recently accumulated 10,758 ETH, valued at approximately $32.14 million, through transactions on Binance since May 2. This strategic accumulation follows Ethereum’s nearly 20% decline in value over the past 30 days, although it is still trading slightly above the $3,000 level, marking an approximate 30% increase year-to-date.

Analysts and investors are closely monitoring these whale movements for signs of a possible market rebound. However, strong resistance around the $3,200 mark and ongoing market challenges suggest that any significant rally might still be some time away.

$ETH / $USD – Update

Looking at this here .. My plan of action on #Ethereum just need to hold $2,700 pic.twitter.com/6swASYcuMN

— Crypto Tony (@CryptoTony__) May 9, 2024

Many crypto analysts are optimistic, notably prominent analyst Crypto Tony, who offered a bullish outlook with a target price of $2,700 for Ethereum. His analysis coincides with the strategic moves of this whale and signals positive sentiment among well-informed market players regarding the price trajectory of Ethereum.

The recent activities of this Ethereum whale highlight a sophisticated use of decentralized finance to significantly influence market positions.

As Ethereum continues to play a pivotal role in the expanding DeFi ecosystem, such strategic investments by major players are likely to shape its valuation and future market dynamics.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.