A prominent crypto analytics firm is warning that the digital asset markets may be on the verge of witnessing a corrective move.

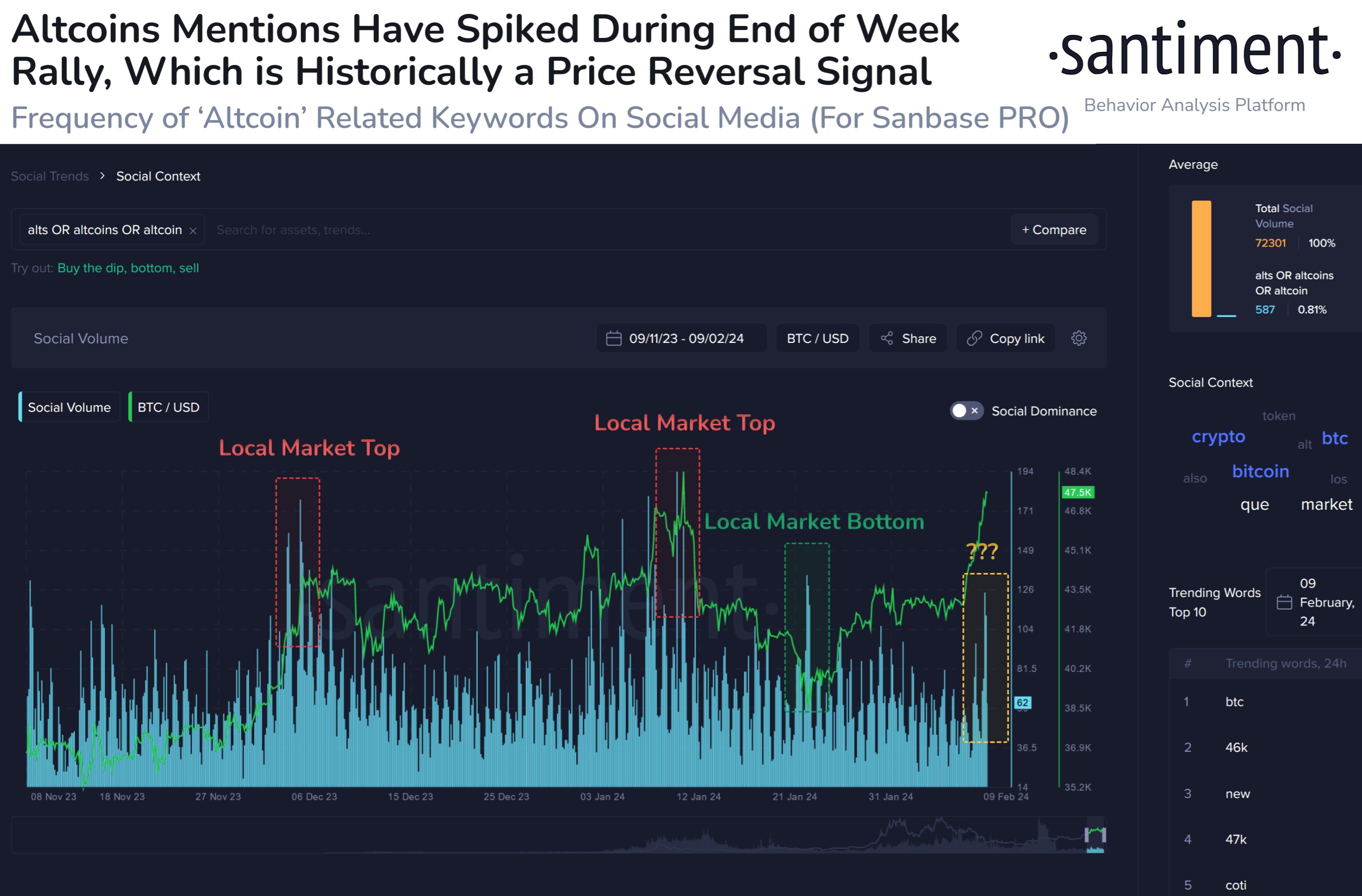

Santiment says on the social media platform X that interest in altcoins has increased in the past few days amid a marketwide rally.

According to the analytics firm, mentions of the terms “alt,” “altcoins” and “altcoin” on social media chatter abruptly rose by the end of last week, suggesting that traders are showing signs of exuberance.

“As crypto total market caps have rocketed upward this week (+5.9%) and volume has soared (+65.4% vs. the previous week), altcoin interest has risen. When this occurs while prices rise, it can be a greed sign.”

Source: Santiment/X

The analytics firm also says the broader crypto markets appear to be following a bullish trend that began in October – the month when Bitcoin (BTC) and altcoins started to witness bursts to the upside.

With the markets flashing signs of greed, Santiment warns that a period of retracement may be on the horizon for Bitcoin and altcoins.

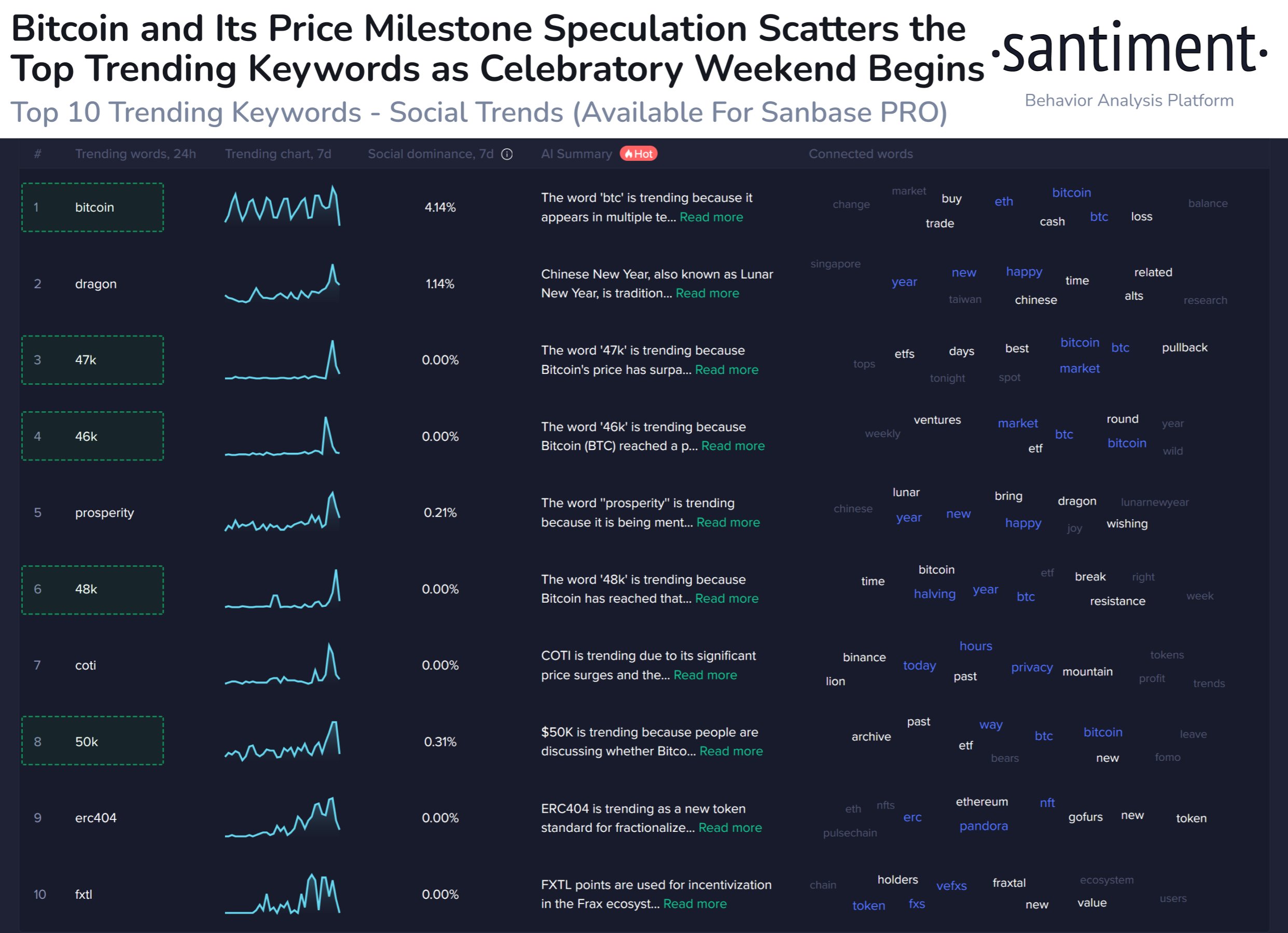

“Bitcoin’s +13% price run in the past week has led traders to speculate numerous new support and resistance milestones, with $50,000 widely anticipated. Ironically, as these price levels have been surpassed altcoins have flipped the script in the opening hours of the weekend as the crowd became overly focused on BTC’s price. The trend throughout the bull cycle that started back in October has been:

- Bitcoin enjoys an isolated pump, crowd becomes BTC dominant

- Profits get distributed into altcoins, crowd gets greedy

- Bitcoin retraces mildly, altseason ends much more drastically.

Monitor how the crowd responds to this 2nd step in the cycle this weekend, and whether begin to raise open interest levels on speculative alts. If so, step 3 likely comes quickly.”

Source: Santiment/X

At time of writing, Bitcoin is trading at $48,196, up 1.41% in the last 24 hours.