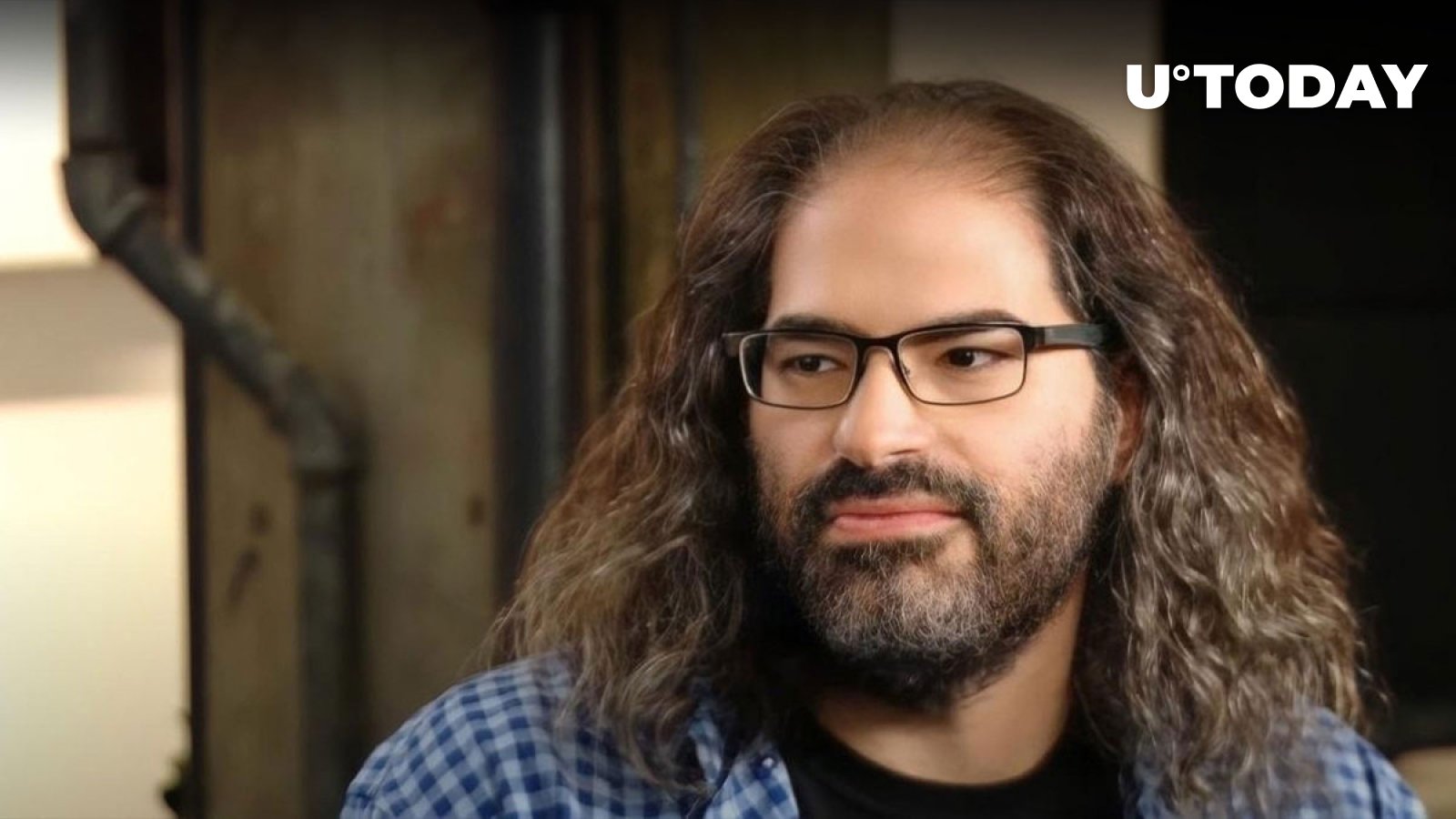

In a riveting twist of events, David Schwartz, CTO at Ripple and mastermind behind the XRP Ledger, unleashed a torrent of criticism against the SEC’s actions in the “DEBT Box case.”

Advertisement

Schwartz accused the securities watchdog of orchestrating an emergency order based on twisted facts to paralyze a cadre of businesses entangled in the controversy.

The SEC’s July bombshell leveled allegations against DEBT Box defendants, alleging a grand scheme dating back to March 2021. The defendants, as per the SEC, peddled unregistered securities disguised as “node licenses,” luring investors with promises of hefty returns through crypto mining and various revenue-generating ventures.

The regulator contends that these seemingly lucrative node licenses were nothing but a smokescreen, veiling the immediate creation of token supplies via intricate blockchain code.

Judge Robert Shelby, presiding over the unfolding drama, recently threw a judicial curveball, casting shadows on the SEC’s legal maneuvers. In a November decision, he hinted at potential sanctions against the regulator’s representatives, citing deceptive statements in their pursuit of justice against DEBT Box.

The court’s initial freezing of the company’s assets, ostensibly due to a relocation to Dubai beyond U.S. regulatory clutches, crumbled under scrutiny. No bank closures were found, and a purported overseas transfer of $720,000 turned out to be a domestic affair.

The judge’s “show cause order” now compels the SEC to justify its potentially rule-violating actions, invoking a federal court rule that demands concrete evidence for factual claims.

As Schwartz publicly condemns the commission’s handling of the DEBT Box saga, the controversy takes on new dimensions. The debate over regulatory overreach and accountability gains fresh momentum, propelled by the developer’s outspoken censure.