Wed, 3/04/2024 – 15:14

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Contents

- Cathie Wood shares her take on Bitcoin’s growth

- “Bitcoin mirrors Nasdaq movements”

Advertisement

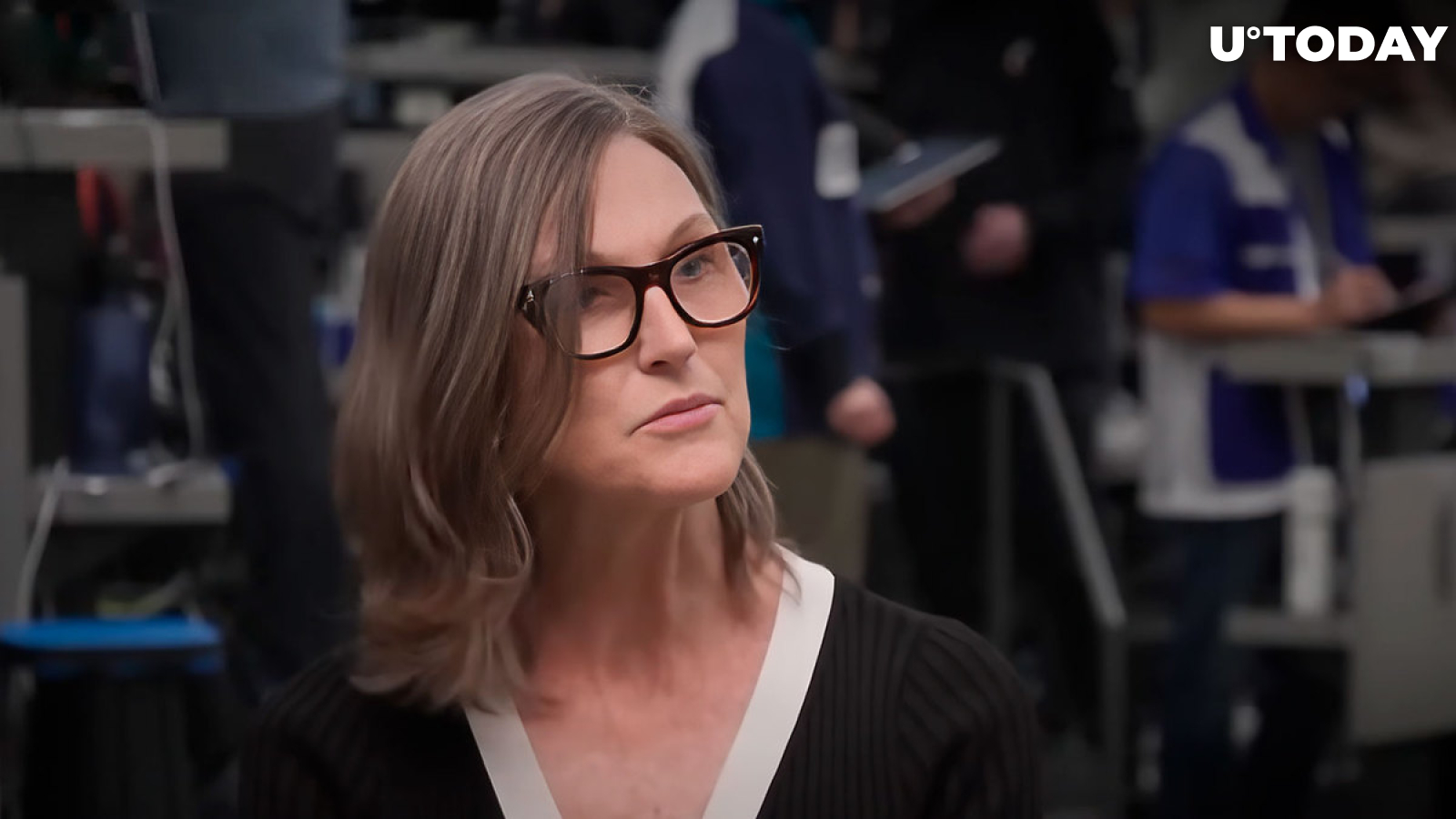

In a recent interview with CNBC anchor Andrew Sorkin, renowned Bitcoiner and chief executive at Ark Invest Cathie Wood shared her take on why Bitcoin had been going up parabolically lately until the recent price fall took place. Sorkin assumed that BTC had been moving in line with the price curves of the Nasdaq 100 index, which makes Bitcoin a risk-on asset.

Cathie Wood shares her take on Bitcoin’s growth

Answering a question about the possible reasons for the recent Bitcoin price hike to a new all-time high of $73,750 in mid-March, the renowned investor mentioned that Bitcoin has been acting as a response and a hedge against various fiat currency devaluations that have been occurring around the world lately, and people have not been talking about them. In this context, Cathie Wood named Egypt, Argentina and Nigeria. This is what has been pushing Bitcoin up high, apart from the driving power of the spot BTC ETFs now, per Wood.

Besides, Bitcoin continues to act as a “flight to safety” and a “hedge against loss of purchasing power and wealth.” Cathie Wood also mentioned that Bitcoin is simultaneously a risk-on asset (for traders and speculators) and a risk-off asset for those who are trying to save their money in countries with rogue regimes or in countries with inefficient monetary policies.

Meanwhile, Ark Invest is one of the companies with a spot Bitcoin ETF, named ARK 21Shares (ARKB). According to BitMEX Research, today was the first time since January that this ETF faced an outflow bigger than that of Grayscale. The amount of $88 million in Bitcoin has left Ark Invest today, dwarfing Grayscale’s $82 million.

“Bitcoin mirrors Nasdaq movements”

Echoing Andrew Sorkin’s take on the recent Bitcoin price rise, cryptocurrency trader and analyst Ali Martinez, who has gained popularity on the X/Twitter social media platform over the past few years, has published a tweet to say he believes that Bitcoin has been mirroring Nasdaq 100 price movements.

The two charts that he published show that even the current Bitcoin pullback coincides with a similar move made by Nasdaq. In order to validate this pattern, the analyst stated, Bitcoin needs to make a swift recovery above the $69,000 price line.

At the time of writing, the world’s first cryptocurrency is changing hands at $66,623.