Sun, 28/01/2024 – 13:10

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The crypto space witnessed seismic shifts in the inaugural month of 2024, particularly in the realm of Bitcoin. The highlight of January was undeniably the groundbreaking move by the world’s largest hedge funds and financial institutions, ushering in the era of spot Bitcoin ETFs.

Advertisement

These developments set off a roller-coaster ride for Bitcoin, with its price oscillating between $48,969 and $38,555 in just 28 days. However, as January bids farewell, the main cryptocurrency has made a resilient rebound, closing the month with a modest gain of 0.7%, nearly retracing its steps to the starting point.

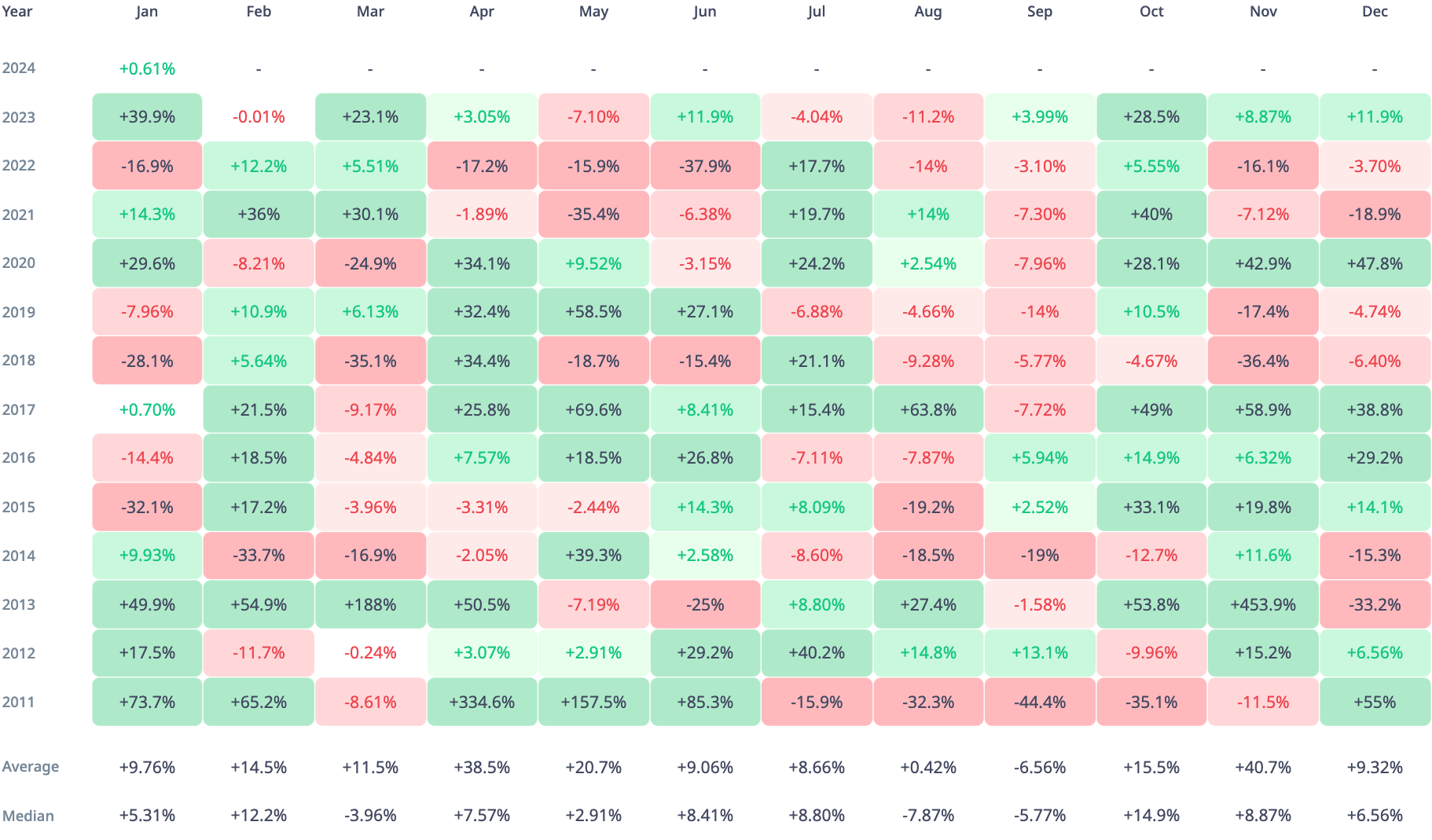

As we step into February, all eyes are on the historical data of Bitcoin prices, and the patterns hint at an intriguing trend. According to CryptoRank statistics covering February from 2011 to 2023, Bitcoin has, on average, exhibited impressive 14.5% profitability, with the median value not far behind at 12.2%.

The significance of this month is further underscored by the fact that the last time the Bitcoin price faced a negative February was in 2020, a memory etched into the minds of those entrenched in the crypto market during that tumultuous time. Prior to that, the cryptocurrency experienced a downturn in February 2014.

Analyzing Bitcoin’s price history reveals a consistent pattern of heightened activity and, more often than not, substantial price movements in February. While acknowledging the ever-changing nature of the crypto market, the extensive track record of BTC as an exchange-traded asset for over a decade provides valuable insights and guidance.